Here is a link to The Guardian coverage

Tuesday, 9 May 2017

Wednesday, 3 May 2017

Applying demand and supply

Below are links to two articles that can be used for applying demand and supply analysis.

Might be useful for IA's or Year 11 VCE assessment.

Might be useful for IA's or Year 11 VCE assessment.

Tuesday, 18 April 2017

Incentives to reduce pollution

The UK is considering a scheme to help remove diesel cars from the roads. This is after years of encouraging diesel fuelled cars by taxing it more favourably than petrol.

The reason for this scheme is that it is now considered that diesel fuel is more polluting than petrol. This is especially true of older diesel engines (mainly an ageing thing I think). The negative externalities of consumption associated with diesel are now thought to be more severe than previously thought (indeed it was thought diesel was better than petrol for the environment because less was needed to travel the same distance).

The proposal might be called a 'nudge' by behavioural economists, because they don't really understand subsidies! This scheme proposes to give a minimum payment, in excess of the market value of old diesel vehicles, to incentivise people to trade in their old vehicle for a brand new one. The new vehicles will emit less pollution and there is therefore a win for the environment as the market moves closer to allocative efficiency.

The scheme will effectively shift the demand curve for new vehicles to the right with the price difference between what the consumer is prepared to pay and the price they must pay covered by the government. Not everyone will trade in their diesel cars and vans, but some will and this will help efforts to reduce harmful pollution.

There is an interesting benefit for car and van manufacturers of course, they sell more new vehicles and so there will be a boost to Aggregate Demand and employment. The benefits will go to all manufacturers, not just those in the UK and so a Europe wide scheme would make the most sense.

The reason for this scheme is that it is now considered that diesel fuel is more polluting than petrol. This is especially true of older diesel engines (mainly an ageing thing I think). The negative externalities of consumption associated with diesel are now thought to be more severe than previously thought (indeed it was thought diesel was better than petrol for the environment because less was needed to travel the same distance).

The proposal might be called a 'nudge' by behavioural economists, because they don't really understand subsidies! This scheme proposes to give a minimum payment, in excess of the market value of old diesel vehicles, to incentivise people to trade in their old vehicle for a brand new one. The new vehicles will emit less pollution and there is therefore a win for the environment as the market moves closer to allocative efficiency.

The scheme will effectively shift the demand curve for new vehicles to the right with the price difference between what the consumer is prepared to pay and the price they must pay covered by the government. Not everyone will trade in their diesel cars and vans, but some will and this will help efforts to reduce harmful pollution.

There is an interesting benefit for car and van manufacturers of course, they sell more new vehicles and so there will be a boost to Aggregate Demand and employment. The benefits will go to all manufacturers, not just those in the UK and so a Europe wide scheme would make the most sense.

This article has most relevance to IB who look at market failure in more detail than VCE. It is, however, a useful example of how governments can intervene in markets to improve resource allocation for everyone. Please note the Daily Express is not the only paper to cover this and I'd never recommend it as a serious newspaper generally, but I thought the Guardian and BBC deserved a rest.

Monday, 27 March 2017

Manipulating supply to raise prices

OPEC is a group of countries that produce oil and in the 1970's formed a cartel to try and raise the revenue they received from oil production. They were very successful then, but today there are many oil producers who are not members of OPEC and so their ability to influence the market has declined.

There is more oil production capacity than there is demand, and presently more oil is produced than the market wants. This situation of excess supply has depressed oil prices.

OPEC has tried to reduce supply from its members, with the cooperation of a few other countries, in order to raise oil prices. They succeeded, but the agreement is running out and there is talk of extending it.

There are some useful areas to investigate.

1. The oil price has fluctuated in anticipation of the agreement being renewed and to news about the level of oil stocks. Why?

2. The members of OPEC have an incentive to agree production limits and then cheat by producing more. Is this always true in cartels?

3. Why is the oil market producing so much more than the market requires? (The move away from fossil fuels and the rate of economic growth are both relevant here.)

4. Who gains and who loses from the lower oil price?

There is more oil production capacity than there is demand, and presently more oil is produced than the market wants. This situation of excess supply has depressed oil prices.

OPEC has tried to reduce supply from its members, with the cooperation of a few other countries, in order to raise oil prices. They succeeded, but the agreement is running out and there is talk of extending it.

There are some useful areas to investigate.

1. The oil price has fluctuated in anticipation of the agreement being renewed and to news about the level of oil stocks. Why?

2. The members of OPEC have an incentive to agree production limits and then cheat by producing more. Is this always true in cartels?

3. Why is the oil market producing so much more than the market requires? (The move away from fossil fuels and the rate of economic growth are both relevant here.)

4. Who gains and who loses from the lower oil price?

Labels:

cartel,

consumer surplus,

Demand and supply,

excess supply,

Expectations,

Global warming,

market clearing.

Tuesday, 21 March 2017

A trade off for monetary policy

Since the global financial crisis interest rates in the UK (and the US, Europe and Japan) have been at record lows. The aim was to boost Aggregate Demand and avoid prolonged recession and promote faster recovery. An interesting trade-off has been highlighted as a result of this policy.

The low interest rates have indeed maintained UK output, according to a Bank of England economist, but the low rates have meant firms that should have ceased operations have been able to survive. Around 1.5 million jobs have been protected according to Andrew Haldane.

Of course saving jobs was exactly what the Bank of England were trying to do when they lowered rates. The unintended consequence of this action was that it reduced the costs of poorly performing firms. Those who were not efficient enough to earn the profits necessary to repay loans at 'normal' rates of interest have been able to survive ('Zombie firms' according to Haldane).

The impact has been to allow low productivity jobs to survive and this has led to poor improvements in productivity overall, because the productivity figures reported are an average over the whole economy.

Productivity is a measure of efficiency. It records how many inputs are required to produce a given level of output. For economic growth to deliver higher standards of living a rise in productivity year on year is crucial. The UK has a very poor productivity record generally and the low interest rates since 2008 have allowed this to get worse.

Haldane says that he is happy to have seen 1.5 million jobs saved rather than 2% productivity growth. At least 1.5 million people and their families will be agreeing with him.

The low interest rates have indeed maintained UK output, according to a Bank of England economist, but the low rates have meant firms that should have ceased operations have been able to survive. Around 1.5 million jobs have been protected according to Andrew Haldane.

Of course saving jobs was exactly what the Bank of England were trying to do when they lowered rates. The unintended consequence of this action was that it reduced the costs of poorly performing firms. Those who were not efficient enough to earn the profits necessary to repay loans at 'normal' rates of interest have been able to survive ('Zombie firms' according to Haldane).

The impact has been to allow low productivity jobs to survive and this has led to poor improvements in productivity overall, because the productivity figures reported are an average over the whole economy.

Productivity is a measure of efficiency. It records how many inputs are required to produce a given level of output. For economic growth to deliver higher standards of living a rise in productivity year on year is crucial. The UK has a very poor productivity record generally and the low interest rates since 2008 have allowed this to get worse.

Haldane says that he is happy to have seen 1.5 million jobs saved rather than 2% productivity growth. At least 1.5 million people and their families will be agreeing with him.

As this is an article about the UK as an example it is directly useful to IB students. However VCE students can see the example of how all policy has trade-offs and policy actions often have unintended consequences, such as supporting inefficiency to reduce unemployment.

Labels:

Aggregate demand,

Economic growth,

Interest rates,

Monetary Policy,

Productivity Commission,

recession,

Standard of Living

Thursday, 16 March 2017

Record high underemployment in Australia

The latest unemployment figures for Australia show a number of worrying indicators.

- A rise in unemployment overall (to 5.9% of the workforce)

- A record high in underemployment (1.1 million people are employed but want to work longer hours)

- Falling numbers of full-time jobs

This all helps explain why wages growth in Australia is also at record lows. There is simply too much supply in the labour market for wages to rise. This may be because of a number of reasons, for example, an increasing workforce (immigration and more young people joining the market than older ones leaving it), or lower demand for goods and services made by Australians leading to less demand for workers.

The prospect of falling Aggregate Demand (AD) is clearly a possibility. At present the rise in commodity prices is helping to boost exports, assisting modest AD growth, but isn't really employing any more people (because its the value not the volume of exports which is rising).

This is going to present difficult policy options for the Government (budgetary/fiscal policy) and the Reserve Bank of Australia on interest rates.

Labels:

Aggregate demand,

Budgetary Policy,

Exports,

Fiscal Policy,

Immigration,

Interest rates,

Underemployment,

Unemployment,

Unemployment Rate,

wages growth,

Workforce

Wednesday, 15 March 2017

The Fed tries to keep 'ahead of the game'

Eddie George, the former Governor of the Bank of England, described the role of Monetary Policy as 'keeping ahead of the game'. By this he meant central banks have to act early, in anticipation of movements in the economy.

The Federal Reserve Bank of the USA (the Fed) has raised its base interest rate from 0.75% to 1. The base (or benchmark) interest rate is important because all other interest rates in an economy are like rafts to the base rates tide. When the tide comes in all the rafts go up. All US commercial interest rates (like personal loans, savings rates and mortgage rates) will rise as a result.

The article points out that the US, like the UK and EU, has an inflation target of 2%. In all three inflation is around that level, but only the Fed is raising rates. This is where Eddie George's phrase becomes relevant. Monetary policy has 'long and variable lags' and takes up to two years to take full effect. The Fed is anticipating changes in the US economy and setting higher rates for what will happen in the future.

This is a very good topic for a Macro IA and you should follow the interest rate changes in major economies. (Note the 'analysis' section of the BBC story below makes this an unsuitable article for an IA, because it is doing the job you need to do in the IA, but there are lots of other reports.)

The Federal Reserve Bank of the USA (the Fed) has raised its base interest rate from 0.75% to 1. The base (or benchmark) interest rate is important because all other interest rates in an economy are like rafts to the base rates tide. When the tide comes in all the rafts go up. All US commercial interest rates (like personal loans, savings rates and mortgage rates) will rise as a result.

The article points out that the US, like the UK and EU, has an inflation target of 2%. In all three inflation is around that level, but only the Fed is raising rates. This is where Eddie George's phrase becomes relevant. Monetary policy has 'long and variable lags' and takes up to two years to take full effect. The Fed is anticipating changes in the US economy and setting higher rates for what will happen in the future.

This is a very good topic for a Macro IA and you should follow the interest rate changes in major economies. (Note the 'analysis' section of the BBC story below makes this an unsuitable article for an IA, because it is doing the job you need to do in the IA, but there are lots of other reports.)

While this is about UK monetary policy the basics of monetary policy are the same in Australia, so useful for both VCE and IB students.

Eddie George was an almost fanatical player of Bridge. He attributed his initil success at the Bank of England to playing with various important people!

Labels:

Inflation,

Inflation target,

Interest rates,

Monetary Policy,

time lags

Thursday, 9 March 2017

Is Quantitative Easing working in Europe?

The European Central Bank has been fighting the danger of deflation in the Euro Area. Deflation is a sustained fall in the general price level so that the purchasing power of money rises.

The purchasing power of money rising sounds good! However it is generally caused by low demand and so low growth, or even falling output. The most recent period of prolonged deflation occured during the Great Depression, and nobody wants to go back to that. When prices are falling consumers will wait to buy good and services as they expect them to become cheaper. The result is a downward spiral of prices and output.

The ECB has been using conventional expansionary monetary policy, interest rates are now 0%, and unconventional monetary policy, they are printing Euros through Quantitative Easing, in order to boost Aggregate Demand (AD) and so economic growth.

The report below suggests that this is now having some effect, but it is far from certain that a sustained upswing in output, wages and prices has yet been achieved, so they will continue the policy. (Note the difference in headline and core inflation which indicates that there is still some way to go before there is a sustained recovery.)

The purchasing power of money rising sounds good! However it is generally caused by low demand and so low growth, or even falling output. The most recent period of prolonged deflation occured during the Great Depression, and nobody wants to go back to that. When prices are falling consumers will wait to buy good and services as they expect them to become cheaper. The result is a downward spiral of prices and output.

The ECB has been using conventional expansionary monetary policy, interest rates are now 0%, and unconventional monetary policy, they are printing Euros through Quantitative Easing, in order to boost Aggregate Demand (AD) and so economic growth.

The report below suggests that this is now having some effect, but it is far from certain that a sustained upswing in output, wages and prices has yet been achieved, so they will continue the policy. (Note the difference in headline and core inflation which indicates that there is still some way to go before there is a sustained recovery.)

Labels:

Aggregate demand,

Deflation,

Economic growth,

Interest rates,

Monetary Policy,

Quantitative easing

Monday, 6 March 2017

Carbon emissions do respond to policy

In Australia it is common to come across both climate change deniers and those who deny that policy measures to reduce global warming will be effective. Often the claim is made that the policy measures do too much harm to people's livelihood's now to be worth the benefits later (dingos kidneys obviously).

The story below from the BBC reports on a record fall in UK coal use and as a result carbon emissions. It is a story that suggests when policy is properly applied it can have a significant impact.

In the case of the UK (and here you can read a combination of EU and UK policy) thare are a raft of complementary policies that have driven lower emissions.

Briefly the UK policy includes:

The story below from the BBC reports on a record fall in UK coal use and as a result carbon emissions. It is a story that suggests when policy is properly applied it can have a significant impact.

In the case of the UK (and here you can read a combination of EU and UK policy) thare are a raft of complementary policies that have driven lower emissions.

Briefly the UK policy includes:

- Setting a carbon budget - a proposed limit to carbon emissions that falls over time

- Taxing carbon emissions, including a minimum tax on carbon.

- Subsidizing renewable energy.

- Promoting and funding a shift away from coal to cleaner fuels (move to low-carbon technologies)

- Funding public information of the dangers of global warming and ways to reduce carbon emissions.

- Subsidizing home improvements and strict regulation on new building standards e.g. insulation standards such as compulsory double glazing.

The message here is that one policy alone is not really that effective, but a combination of policies that raise the price and shift the demand curve to the left do have a significant effect.

One point to note is that serious attempts in UK policy on this issue began in 1990. While policy has intensified since 2006 there has been a fairly sudden change recently, as the article notes. Initially policy met an inelastic response to price changes and only minor changes that could be said to have moved the demand curve left.

Now the policy has reached the 'tipping point'. We are observing an elastic response to price (see article) and behaviour has been changed. Economists knew this point would be reached, but predicting how much pressure needed to be applied to reach it was never clear.

David Pearce, you were right. I'm sorry you never lived to see it.

Labels:

Carbon budget,

Carbon Tax,

Climate change,

Demand and supply,

Global warming,

Price elasticity of demand,

Regulation,

Subsidies

Thursday, 2 March 2017

Two demand and supply news articles

These links are to articles you can apply demand and supply to

Strawberries in the UK

Demand for Bananas

Strawberries in the UK

Demand for Bananas

Sunday, 26 February 2017

Reducing overtime (penalty) rates in Australia

There is a long tradition of paying workers extra when they work hours that fall outside the normal working week. In Australia these are called Penalty Rates, and called Overtime Rates elsewhere.

Australia has a strong labour movement and was the first country to establish the 'eight hour day', five days a week as standard. They guard their free time jealously and so a system of paying penalty rates to whoever works at certain times has grown up. A particularly difficult area is Sunday trading where many workers earn 'double time', including casual staff who might only work on Sunday.

Now the Australian Fair Work Commission have concluded an enquiry and recommended that the rates be reduced.

There are several points to be made on each side of the debate.

This measure is a supply-side policy that aims to lower costs and improve long-run growth.

Australia has a strong labour movement and was the first country to establish the 'eight hour day', five days a week as standard. They guard their free time jealously and so a system of paying penalty rates to whoever works at certain times has grown up. A particularly difficult area is Sunday trading where many workers earn 'double time', including casual staff who might only work on Sunday.

Now the Australian Fair Work Commission have concluded an enquiry and recommended that the rates be reduced.

There are several points to be made on each side of the debate.

- Penalty rates allow low paid workers to boost their pay to a level where they can earn a reasonable living wage. Therefore reducing penalty rates may reduce equity in Australia.

- Also penalty rates provide the incentive to workers to supply additional hours of work. When the incentive is removed then the capacity of the Australian economy will be reduced (affecting Aggregate Supply).

- Against these points must be set the higher costs penalty rates impose on businesses. these will now be reduced and consumers may benefit through lower prices and improved supply. The labour market will become more flexible and Australian competitiveness will be improved.

This measure is a supply-side policy that aims to lower costs and improve long-run growth.

This story is directly relevant to VCE students and represents an excellent example of Australian Supply-side policy. IB students can equally use it as an example.

Labels:

Aggregate Supply,

Competitiveness,

Equity,

incentives,

Living wage,

Penalty rates,

Supply-side policy

Wednesday, 22 February 2017

A step towards freer trade

The Doha Round of the World Trade Organization (WTO) has been making little progress as many countries fail to agree to trade policy reform. Rather than wait for a general agreement the WTO agreed to implement a partial agreement known as the The Trade Facilitation Agreement (TFA).

The TFA essentially makes customs procedures easier, saving time and other costs. It is estimated that this will raise trade by $1trillion a year and be as effective as cutting all tariffs.

The benefits of free trade are well known. There is greater specilization and trade, resources are allocated more efficiently and consumer surplus will rise. Of course there will be losers, as resources are reallocated and some structural unemployment is caused. The key is to look at this as long-term gain at the price of some shorter term pain in a few sectors.

Note how long this agreement has taken however. At least fifteen years in the making, including three years to get countries to ratify the agreement. A big plus is that Developing countries will probably be winners from this agreement. Critics of the WTO have often suggested that they favour the developed countries, but this seems to make life easier to access the markets of the richer countries.

The TFA essentially makes customs procedures easier, saving time and other costs. It is estimated that this will raise trade by $1trillion a year and be as effective as cutting all tariffs.

The benefits of free trade are well known. There is greater specilization and trade, resources are allocated more efficiently and consumer surplus will rise. Of course there will be losers, as resources are reallocated and some structural unemployment is caused. The key is to look at this as long-term gain at the price of some shorter term pain in a few sectors.

Note how long this agreement has taken however. At least fifteen years in the making, including three years to get countries to ratify the agreement. A big plus is that Developing countries will probably be winners from this agreement. Critics of the WTO have often suggested that they favour the developed countries, but this seems to make life easier to access the markets of the richer countries.

This story is most directly useful to IB students as it deals with global trade agreements and the WTO. However VCE students need to understand the benefits of trade and Australia is a party to all WTO agreements, so is also an example of Australian trade policy.

Labels:

consumer surplus,

Development economics,

Free trade,

Protectionism,

specialization and trade,

structural unemployment,

Tariffs,

WTO

Sunday, 19 February 2017

Sugar tax in Australia

The sugar tax is a rich topic for IA's in microeconomics. Australia is now starting discussions at State and Federal level on the possibility of introducing one. Look out for possible articles on this and save them up!

Tuesday, 14 February 2017

A danger for Australia's economy

The ABC today report that the level of Australian household debt has reached 187% of disposable income. This is, they say, the highest in the world.

The problem is that this means that many households are close to not being able to afford to pay their debts (and interest) and buy the goods and services they need. If there was a rise in interest rates, or rise in unemployment this would see more and more households 'running out of money'.

The effect this will have on Australia is that Consumer spending would fall, leading to a lower level of Aggregate Demand (AD). This would put downward pressure on economic growth and could push Australia into its first recession since 1981.

Admittedly this is the 'disaster' scenario. There are other factors that simultaneously affect the economy. However it provides a constraint on the Reserve Banks ability to raise interest rates and should warn the government that further budget cuts and tax rises could combine to cause the recession everyone seeks to avoid.

Debt is a fact of life. It makes sense to borrow to buy a house. There is, however, a limit to the amount of debt a household can take on - the amount they can repay. If banks think households have reached their ability to pay then new loans will start to dry up and consumer spending will fall, leading to that fall in AD we feared. In that situation monetary policy becomes less effective, because lowering interest rates won't help much.

This is an important piece of background to Australia's current economic situation.

The problem is that this means that many households are close to not being able to afford to pay their debts (and interest) and buy the goods and services they need. If there was a rise in interest rates, or rise in unemployment this would see more and more households 'running out of money'.

The effect this will have on Australia is that Consumer spending would fall, leading to a lower level of Aggregate Demand (AD). This would put downward pressure on economic growth and could push Australia into its first recession since 1981.

Admittedly this is the 'disaster' scenario. There are other factors that simultaneously affect the economy. However it provides a constraint on the Reserve Banks ability to raise interest rates and should warn the government that further budget cuts and tax rises could combine to cause the recession everyone seeks to avoid.

Debt is a fact of life. It makes sense to borrow to buy a house. There is, however, a limit to the amount of debt a household can take on - the amount they can repay. If banks think households have reached their ability to pay then new loans will start to dry up and consumer spending will fall, leading to that fall in AD we feared. In that situation monetary policy becomes less effective, because lowering interest rates won't help much.

This is an important piece of background to Australia's current economic situation.

OECD data suggests Australia has high household debt, but not the highest

Thursday, 9 February 2017

German trade surplus and another mad Trump claim

Germany has posted a record trade surplus on its current account. This really means that Germany has exported more than it imported. It should be noted that both exports and import values grew, but export values grew faster.

Trade surpluses are not 'good' and deficits are not 'bad'. There should be a broad balance over time on the current account. If there are persistent deficits this suggests that a country will build up foreign debt and isn't competitive. A persistent surplus means that the Aggregate Demand in the economy is being boosted, leading to inflationary pressures and demand for the currency, to buy the exports, will force up the exchange rate.

Trump's trade advisor has accused Germany of using the weak value of the Euro to boost its exports. This bizarre claim is just another conspiracy theory. The value of the Euro is determined by the market and the European Central Bank (ECB) is independent of governments in setting monetary policy.

The claim does however allow us to realise that Germany is concerned to reduce its trade deficit because of the effect it has on the domestic economy. As pointed out in the article Germany has taken steps to boost domestic demand in order to stimulate demand for imports. Some of the measures are detailed in the article.

Not for the first time though the article demonstrates that the Trump administration is just batshit crazy.

Trade surpluses are not 'good' and deficits are not 'bad'. There should be a broad balance over time on the current account. If there are persistent deficits this suggests that a country will build up foreign debt and isn't competitive. A persistent surplus means that the Aggregate Demand in the economy is being boosted, leading to inflationary pressures and demand for the currency, to buy the exports, will force up the exchange rate.

Trump's trade advisor has accused Germany of using the weak value of the Euro to boost its exports. This bizarre claim is just another conspiracy theory. The value of the Euro is determined by the market and the European Central Bank (ECB) is independent of governments in setting monetary policy.

The claim does however allow us to realise that Germany is concerned to reduce its trade deficit because of the effect it has on the domestic economy. As pointed out in the article Germany has taken steps to boost domestic demand in order to stimulate demand for imports. Some of the measures are detailed in the article.

Not for the first time though the article demonstrates that the Trump administration is just batshit crazy.

The size of Germany's Current Account surplus compared to GDP for the last ten years, shows a growing issue.

This article is primarily of use to IB students in its detail. However the effects of a trade surplus and the effect of currency value is important knowledge for VCE students.

Labels:

Current Account,

exchange rates,

Exports,

Imports,

Inflation,

Monetary Policy,

Net exports

Tuesday, 7 February 2017

Australian interest rates stay at record low

As expected the Reserve Bank of Australia (RBA) kept interest rates on hold at their meeting yesterday. They remain at the record low of 1.5%.

The RBA forecast that the Australian economy would continue to grow at about 3% in 2017, but that inflation remains below target. Therefore the RBA wishes to encourage the economy to grow faster by keeping it cheap to borrow and so encouraging consumer spending and investment, both components of Aggregate Demand.

Australian interest rates may stay the same for a while. The pressure to raise them might come from higher growth and a rapidly rising housing market. However the pressure to put them down will come from a rising exchange rate (based on events in the USA where interest rates will rise).

Monetary policy is a very important tool in managing the economy and works by affecting the total level of demand in the economy.

Below are two links. The ABC one is for Year 12, the Channel Nine one for Year 11.

The RBA forecast that the Australian economy would continue to grow at about 3% in 2017, but that inflation remains below target. Therefore the RBA wishes to encourage the economy to grow faster by keeping it cheap to borrow and so encouraging consumer spending and investment, both components of Aggregate Demand.

Australian interest rates may stay the same for a while. The pressure to raise them might come from higher growth and a rapidly rising housing market. However the pressure to put them down will come from a rising exchange rate (based on events in the USA where interest rates will rise).

Monetary policy is a very important tool in managing the economy and works by affecting the total level of demand in the economy.

Australia's policy interest rate since 2014

VCE students must be able to explain policy decisions and economic events in Australia over the previous two years prior to their examination. Interest rate decisions (monetary policy) is one of the areas they must be familiar with and be able to explain why policy decisions (change interest rates etc) we made.

IB students can use this as an example of monetary policy too.

Friday, 3 February 2017

A shift in the supply curve

Supermarkets in the UK are abandoning reliance on the price mechanism alone and have introduced rationing of lettuce. This is very unusual in the market economy, which can usually be relied upon to provide the goods and services you want at the prices you expect.

The reason for this move is the sudden fall in supply caused by poor weather conditions in Spain (a condition of supply). The graph below shows how this has affected the market.

The reason for this move is the sudden fall in supply caused by poor weather conditions in Spain (a condition of supply). The graph below shows how this has affected the market.

The bad weather has called a fall in supply and so the market supply curve has shifted from S1 to S2. This has led to a rise in price from 40p to 1.40 as the market no clears at the point where the demand and supply curves cross.

Because lettuce is a primary product demand is inelastic (not very responsive) and the result is a very large rise in price following the reduction in supply.

The UK supermarkets are now rationing lettuce to avoid even higher price rises. The shortage of lettuce is leading to panic buying. Consumers see lettuce and buy more than they need just in case there are none the next time they shop. This pushes the demand curve, D, to the right, forcing the market equilibrium even higher.

The actions of the supermarkets may seem unnecessary, but they are reacting based on their knowledge of consumer behaviour and market forces.

This story has a lot of terms Year 11 will not currently understand, but they will soon. It has been written is an accessible way rather than a technical way. It is equally useful for IB and VCE students as it is about the basic market mechanism. IB students might search for similar stories from other sources in case they feel it is an IA candidate.

Wednesday, 1 February 2017

Australia posts record Balance of Trade surplus

It is a matter of some celebration that Australia has achieved its largest Balance of Trade surplus ever in December 2016. This means that the value of exports in goods and services was greater than the value of imports of goods and services. As shown in the graph below this is unusual for Australia.

The main reason for the boost is that the price of commodities has risen and so have the volume of exports. So Australia has exported more and got more for what they have sold. Chinese demand is crucial in this process.

There are other reasons for the improvement, one being the increased competitiveness of Australian goods and services due to the lower value of the dollar in recent years. However it is mainly commodities and that really is down to China.

Don't get too excited because the Australian Current Account remains in deficit and has been since 1974. The Current Account includes the Balance of Trade, net income and transfers. This clearly implies that the deficit on income and transfers outweighs the Balance of Trade surplus. The graph below shows the Current Account balance for the last ten years to compare with the Balance of Trade above (note that the data for last three months are not yet available below).

The main reason for the boost is that the price of commodities has risen and so have the volume of exports. So Australia has exported more and got more for what they have sold. Chinese demand is crucial in this process.

There are other reasons for the improvement, one being the increased competitiveness of Australian goods and services due to the lower value of the dollar in recent years. However it is mainly commodities and that really is down to China.

Don't get too excited because the Australian Current Account remains in deficit and has been since 1974. The Current Account includes the Balance of Trade, net income and transfers. This clearly implies that the deficit on income and transfers outweighs the Balance of Trade surplus. The graph below shows the Current Account balance for the last ten years to compare with the Balance of Trade above (note that the data for last three months are not yet available below).

There are always implications for of Current Account deficit, such as the effect on Aggregate Demand, a Financial Account surplus, rising foreign debt and the possibility that the country is uncompetitive. A 43 year Current Account deficit suggests the competitivness point has been settled.

This topic is a crucial one for VCE students who should consider the impact on Australia's Net Foreign Debt position and what it says about the country's dependence on China and commodities. IB students will equally be able to use it as an example of International Trade and the wider effects of deficits and surpluses.

Thursday, 19 January 2017

Free trade - good or bad?

There are going to be a lot of articles on protectionism (Trump) and access to markets (Brexit) coming up. The article below looks at whether free trade is good or bad. Handy points of evaluation to deploy on articles about trade that might be used for IA's.

Tuesday, 17 January 2017

Effects of inflation

For those thinking of looking at rising inflation (say in the UK in December, reported yesterday) here is a little article on who wins and who loses from inflation. (Read stakeholders and evaluation!)

Thursday, 12 January 2017

Look out for the 'J curve'

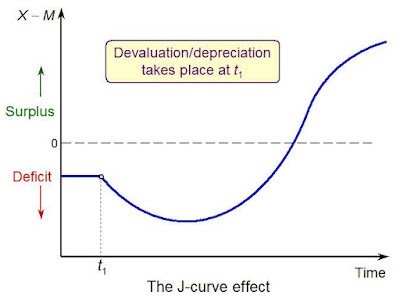

Economic theory tells us that when a countries currency depreciates (falls in value) that export prices fall, import prices rise and that following the law of demand the level of net exports, X - M, (the balance of trade or current account) will grow.

It's not quite as simple as that. Firstly it takes time for the change in export and import volumes to occur. At first they will stay the same. This means at first export values stay the same (valued in the country's currency) and import values rise (values in the country's currency). So the balance of trade, or current account or net exports at first gets worse.

Providing the Marshall-Lerner conditions hold over time exports grow as foreigners realize they are now cheaper and imports fall as domestic customers switch to home produced alternatives. Therefore the reaction of net exports should be to initially worsen, then improve, and when plotted against time this looks like a 'J'.

It's not quite as simple as that. Firstly it takes time for the change in export and import volumes to occur. At first they will stay the same. This means at first export values stay the same (valued in the country's currency) and import values rise (values in the country's currency). So the balance of trade, or current account or net exports at first gets worse.

Providing the Marshall-Lerner conditions hold over time exports grow as foreigners realize they are now cheaper and imports fall as domestic customers switch to home produced alternatives. Therefore the reaction of net exports should be to initially worsen, then improve, and when plotted against time this looks like a 'J'.

Following the Brexit vote the value of the British pound fell, up to 20%. Therefore we might expect to see a J-curve effect on the British trade balance.

The data does not yet show this clearly. One reason is that the effect from t1 in the diagram above to the point where the current account turns into a surplus is thought to be about a year and a half. As we are six months in to the process we should only have seen a worsening of the trade balance so far.

UK Balance of trade December 2015 to November 2016 (latest data available in Jan 17)

The data shows the initial worsening we would expect in the balance of trade after the late June vote and fall in the pounds value. This isn't a smooth J-curve though.

The reason that we don't see a textbook J-curve is because all variables don't stay the same. In 1967 the UK devalued the pound in a fixed exchange rate system from 1:US$2.8 to 1:US$2.4. And that rate remained fixed until 1971. Therefore there was certainty and stability in the exchange rate after 1967. That isn't true of the current situation, where the pound continues to fluctuate in value in a free floating exchange rate system.

UK Pound value against US$ Jan 2016 to Jan 2017

As is clear from the path taken by the UK pound against the US$ there remain variations in value. This is partly because of changing business and consumer confidence as more news arises over the likely results of Brexit.

Therefore we should be looking for evidence of a J-curve effect, but remember we don't live in a world where one change is followed by stability of all variables that allow us to see the elegant relationship the textbooks tell us about. But it should be there, just partially obscured.

This topic is of specific interest to IB students for their international economics section of the course. However the effect of the changing value of a currency is equally important to VCE students as the fall in the exchange rate of the A$ since 2012 and especially since 2014 is highly significant.

Labels:

balance of trade,

Business confidence,

Consumer Confidence,

depreciation,

devaluation,

Exports,

fixed exchange rates,

Floating exchange rates,

Imports,

J-Curve,

Marshall-Lerner conditions,

Net exports

Wednesday, 4 January 2017

Are incentives irrelevant?

Finland has begun an experiment where it will pay unemployed citizens a fixed monthly sum. The idea is based on a 'universal basic income'. Other countries are going to start similar experiments.

The idea of a basic minimum income, regardless of economic activity, is one that is very attractive to those who are concerned with addressing inequality. It is controversial because opponents say it will simply encourage idleness.

Traditional supply side economic theory says that if the difference between in-work and out-of-work income is too small then there is too little incentive to take up job offers. People remain unemployed until a better offer comes along. When the difference is large then the unemployed jump at a job offer, therefore governments have cut the real value of the unemployment benefit sine the 1980's.

Supporters say that it is more important to deal with inequality which has risen continuously since the 1980s. This was not promised by supply side theory which said that the initial the rise in inequality would be reversed due to faster economic growth. (Unkindly some say this is the 'trickle down' effect, but actually they envisaged faster productivity growth and so higher wages throughout the economy.)

Others point to the fact that the system is very cheap to administer. There are no tests, no adjustments (even if the recipient finds work) and so minimal clerical effort. Therefore government expenditure is partly offset by lower costs of administration.

It's something you may want to watch.

The idea of a basic minimum income, regardless of economic activity, is one that is very attractive to those who are concerned with addressing inequality. It is controversial because opponents say it will simply encourage idleness.

Traditional supply side economic theory says that if the difference between in-work and out-of-work income is too small then there is too little incentive to take up job offers. People remain unemployed until a better offer comes along. When the difference is large then the unemployed jump at a job offer, therefore governments have cut the real value of the unemployment benefit sine the 1980's.

Supporters say that it is more important to deal with inequality which has risen continuously since the 1980s. This was not promised by supply side theory which said that the initial the rise in inequality would be reversed due to faster economic growth. (Unkindly some say this is the 'trickle down' effect, but actually they envisaged faster productivity growth and so higher wages throughout the economy.)

Others point to the fact that the system is very cheap to administer. There are no tests, no adjustments (even if the recipient finds work) and so minimal clerical effort. Therefore government expenditure is partly offset by lower costs of administration.

It's something you may want to watch.

The new VCE study design has downplayed the study of inequality. However at IB it is an important economic goal. There is an IA in this one that looks at the effects on LRAS and AD. Read the article carefully, I have not put in every important detail here.

Labels:

government spending,

Inequality,

Productivity,

Supply-side policy,

Unemployment,

unemployment benefit,

wage rates

Subscribe to:

Comments (Atom)