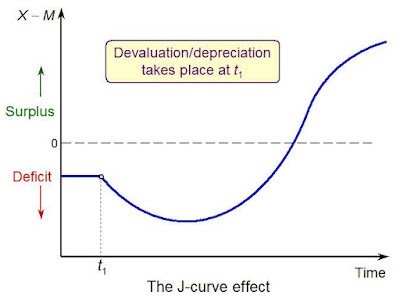

It's not quite as simple as that. Firstly it takes time for the change in export and import volumes to occur. At first they will stay the same. This means at first export values stay the same (valued in the country's currency) and import values rise (values in the country's currency). So the balance of trade, or current account or net exports at first gets worse.

Providing the Marshall-Lerner conditions hold over time exports grow as foreigners realize they are now cheaper and imports fall as domestic customers switch to home produced alternatives. Therefore the reaction of net exports should be to initially worsen, then improve, and when plotted against time this looks like a 'J'.

Following the Brexit vote the value of the British pound fell, up to 20%. Therefore we might expect to see a J-curve effect on the British trade balance.

The data does not yet show this clearly. One reason is that the effect from t1 in the diagram above to the point where the current account turns into a surplus is thought to be about a year and a half. As we are six months in to the process we should only have seen a worsening of the trade balance so far.

UK Balance of trade December 2015 to November 2016 (latest data available in Jan 17)

The data shows the initial worsening we would expect in the balance of trade after the late June vote and fall in the pounds value. This isn't a smooth J-curve though.

The reason that we don't see a textbook J-curve is because all variables don't stay the same. In 1967 the UK devalued the pound in a fixed exchange rate system from 1:US$2.8 to 1:US$2.4. And that rate remained fixed until 1971. Therefore there was certainty and stability in the exchange rate after 1967. That isn't true of the current situation, where the pound continues to fluctuate in value in a free floating exchange rate system.

UK Pound value against US$ Jan 2016 to Jan 2017

As is clear from the path taken by the UK pound against the US$ there remain variations in value. This is partly because of changing business and consumer confidence as more news arises over the likely results of Brexit.

Therefore we should be looking for evidence of a J-curve effect, but remember we don't live in a world where one change is followed by stability of all variables that allow us to see the elegant relationship the textbooks tell us about. But it should be there, just partially obscured.

This topic is of specific interest to IB students for their international economics section of the course. However the effect of the changing value of a currency is equally important to VCE students as the fall in the exchange rate of the A$ since 2012 and especially since 2014 is highly significant.

No comments:

Post a Comment