Material and non-material living standards? The objective ofn strong and sustainable growth?

Sunday, 12 October 2014

Interesting point

Wednesday, 20 August 2014

Collusion but not a cartel or price fixing

The ACCC is taking action to try to close down a website where petrol retailers share information about pump prices.

It would seem that the site, which is a private members site, goes as far as to share information about proposed price changes.

The ACCC believes that this is collusion and against the public interest. It prevents proper competition and so means petrol prices are higher than they would otherwise be.

It should not be a surprise that an oligopoly market structure like petrol retailing leads to some sort of interdependency. But is this collusion? The counter claim is that the information shared is available in large, neon, signs outside petrol stations. Also the nature of the market means that firms charge similar prices and those prices move together.

It is very hard to see if this is collusion or just normal oligopoly behaviour (tacit price leadership). The case will depend on if price changes are discussed in advance. Then it is collusion and there is plenty of case law to support this as the sharing of the information clearly jointly benefits firms interests and works against consumer interests.

Great example if required for the upcoming exam.

It would seem that the site, which is a private members site, goes as far as to share information about proposed price changes.

The ACCC believes that this is collusion and against the public interest. It prevents proper competition and so means petrol prices are higher than they would otherwise be.

It should not be a surprise that an oligopoly market structure like petrol retailing leads to some sort of interdependency. But is this collusion? The counter claim is that the information shared is available in large, neon, signs outside petrol stations. Also the nature of the market means that firms charge similar prices and those prices move together.

It is very hard to see if this is collusion or just normal oligopoly behaviour (tacit price leadership). The case will depend on if price changes are discussed in advance. Then it is collusion and there is plenty of case law to support this as the sharing of the information clearly jointly benefits firms interests and works against consumer interests.

Great example if required for the upcoming exam.

Labels:

ACCC,

cartel,

Collusion,

Contestable markets,

Market failure,

Market structure,

oligopoly,

Price fixing

Tuesday, 19 August 2014

RET, forgotten for a long time, but not gone yet.

The RET is the Renewable Energy Target. It states that Australia should source 20% of its energy generation from renewable sources by 2020.

For Australia the most obvious renewable sources are wind and solar. Wind because huge wind farms can be built in the empty spaces of Australia with minimal environmental impact. Solar because parts of Australia get plenty of sunshine, although actually solar works on cloudy days too.

The point of the RET is to reduce carbon emissions. If renewable sources are used then less coal needs to be burned. Australian coal, especially Victorian coal (brown coal) is really quite 'dirty' with high CO2 emissions.

The government does not like renewable energy. They don't really think action on climate change is important and many suspect they are just pro-mining as they receive strong financial support from that sector.

The government now have a report on what to do with the RET. Written by a climate change sceptic it's likely to add to Australia's disgraceful reputation as a nation of environmental terrorists too poorly educated to grasp the nature of scientific probability.

The Guardian discusses the likely impact of cutting back or abolishing the RET below.

For Australia the most obvious renewable sources are wind and solar. Wind because huge wind farms can be built in the empty spaces of Australia with minimal environmental impact. Solar because parts of Australia get plenty of sunshine, although actually solar works on cloudy days too.

The point of the RET is to reduce carbon emissions. If renewable sources are used then less coal needs to be burned. Australian coal, especially Victorian coal (brown coal) is really quite 'dirty' with high CO2 emissions.

The government does not like renewable energy. They don't really think action on climate change is important and many suspect they are just pro-mining as they receive strong financial support from that sector.

The government now have a report on what to do with the RET. Written by a climate change sceptic it's likely to add to Australia's disgraceful reputation as a nation of environmental terrorists too poorly educated to grasp the nature of scientific probability.

The Guardian discusses the likely impact of cutting back or abolishing the RET below.

Sunday, 10 August 2014

Education cuts - short term gain for long term disadvantage?

The government can't get over its preoccupation with the Budget deficit. Despite the fact that the deficit is both tiny and completely manageable they insist on cutting government spending.

In one way their determination is admirable if they truly believe that the accumulated debt will harm Australia in the long run. However their decision to cut education funding can do nothing but harm Australia in the long run.

The Guardian article below has most of the details. The essence of it is that the price of going to university in Australia will go up if the measures ever pass the Senate and so fewer Australian people will go to university.

The real problem is that the people who won't be able to afford to go are exactly the ones that need to. They will come from lower and middle socio-economic groups who have traditionally gone into low tech and manufacturing employment.

Australia's future prosperity depends on building a better educated workforce able to compete in the global 'knowledge based' economy. For that it needs well educated graduates and a key feature will be getting more people through degree courses. This will help shift the Long Run Aggregate Supply curve to the right that much faster than otherwise and will assist in maintaining non-inflationary growth.

Of course raising the low standard of Australian degrees is out of the question under this scheme. All students must do honours to compete globally. To cut education funding as proposed makes no sense at all.

In one way their determination is admirable if they truly believe that the accumulated debt will harm Australia in the long run. However their decision to cut education funding can do nothing but harm Australia in the long run.

The Guardian article below has most of the details. The essence of it is that the price of going to university in Australia will go up if the measures ever pass the Senate and so fewer Australian people will go to university.

The real problem is that the people who won't be able to afford to go are exactly the ones that need to. They will come from lower and middle socio-economic groups who have traditionally gone into low tech and manufacturing employment.

Australia's future prosperity depends on building a better educated workforce able to compete in the global 'knowledge based' economy. For that it needs well educated graduates and a key feature will be getting more people through degree courses. This will help shift the Long Run Aggregate Supply curve to the right that much faster than otherwise and will assist in maintaining non-inflationary growth.

Of course raising the low standard of Australian degrees is out of the question under this scheme. All students must do honours to compete globally. To cut education funding as proposed makes no sense at all.

Friday, 8 August 2014

RBA less optimisitc on economy

The Quarterly Statement of the RBA has painted a gloomy picture of the economy. Unemployment is forecast to stay high for two years and the rate of growth will be just below trend. Inflation is forecast to be just 2% rather than the 2.75% previously predicted, mainly due to the repeal of the Carbon Tax.

Note that the repeal of the carbon tax does not reduce core (underlying) inflation, only headline inflation as it won't be repeated and will drop out of the index after a year.

The overall implication is that interest rates won't be rising any time soon and this might help bring the exchange rate down. Such a downward movement will be welcomes to exporters.

The Guardian article outlines the main points and contains essential figures to remember!

Note that the repeal of the carbon tax does not reduce core (underlying) inflation, only headline inflation as it won't be repeated and will drop out of the index after a year.

The overall implication is that interest rates won't be rising any time soon and this might help bring the exchange rate down. Such a downward movement will be welcomes to exporters.

The Guardian article outlines the main points and contains essential figures to remember!

Labels:

Australian Data VCE Economics,

Growth,

headline inflation,

Inflation,

Interest rates,

Monetary Policy,

Unemployment

Sunday, 3 August 2014

Politics vs Economics - it's about the facts.

The government want to reduce welfare spending and appointed a multi-millionaire to look at Indigenous welfare and employment to advise them on how to do it. You might think that's an odd choice.

Even odder is that Andrew Forrest decided to report on all welfare spending, not just Indigenous welfare.

He reported that basically welfare is wasted and it should be cut. The trouble is there is not really any evidence to back up his claims that 'welfare spending is out of control'. Nor is Australia's welfare spending large by international comparison, its actually quite similar as a proportion of total government spending.

The argument put forward by government is a supply-side one. If welfare is cut people will be more inclined to work.

However I don't need to bang on about this because below is an article which explains it very clearly.

Even odder is that Andrew Forrest decided to report on all welfare spending, not just Indigenous welfare.

He reported that basically welfare is wasted and it should be cut. The trouble is there is not really any evidence to back up his claims that 'welfare spending is out of control'. Nor is Australia's welfare spending large by international comparison, its actually quite similar as a proportion of total government spending.

The argument put forward by government is a supply-side one. If welfare is cut people will be more inclined to work.

However I don't need to bang on about this because below is an article which explains it very clearly.

The goal of equity. Gone but not forgotten?

Understanding the impact of the budget on output, employment, growth and the Current Account is very important. But what about the other goals? Equity for example.

The Budget seemed regressive in nature when it was announced. The poorer quintiles/deciles appeared to be loosing most and paying more too. Now research (technically modelling by the Treasury) has confirmed this.

Unfortunately the original story in Fairfax media is behind a pay wall, so I have linked to the Guardians shorter story.

Notice the defence by the Fat Controller, that the tax system is progressive so the rich pay more. He misses the point, the report is about the change in equity, not the overall effect. Poor Joe.

The Budget seemed regressive in nature when it was announced. The poorer quintiles/deciles appeared to be loosing most and paying more too. Now research (technically modelling by the Treasury) has confirmed this.

Unfortunately the original story in Fairfax media is behind a pay wall, so I have linked to the Guardians shorter story.

Notice the defence by the Fat Controller, that the tax system is progressive so the rich pay more. He misses the point, the report is about the change in equity, not the overall effect. Poor Joe.

Friday, 1 August 2014

Work for the dole. Will it work?

The government wish to introduce a 'Work for the dole' scheme that will see all unemployed people under 60 being required to do community based work at some point. Details can be found in news reports.

The policy is a supply-side measure. There are several arguments for it.

* There is an increased incentive to the unemployed people to take a job, any job, as they no longer get as much leisure time while out of work.

* The unemployed maintain a 'working routine' and therefore their skills and habits don't decline as quickly making them more attractive to employers despite their period of inactivity.

* The cost to the state of unemployment is not as great as something of value is recovered in return for benefits.

The argument really revolves around the idea that the unemployed are voluntarily unemployed to some extent. Some don't want jobs and others are waiting for the 'right job'. By making unemployment more costly (this includes falls in the value of benefits announced in the budget) by demanding more effort then those out of work are more likely to accept a job offered to them. This effectively shortens the period of unemployment and helps match people to vacancies more willingly.

The problem is that the economic research on this issue says that it does not work. The Saturday Paper reviews this topic below.

The policy is a supply-side measure. There are several arguments for it.

* There is an increased incentive to the unemployed people to take a job, any job, as they no longer get as much leisure time while out of work.

* The unemployed maintain a 'working routine' and therefore their skills and habits don't decline as quickly making them more attractive to employers despite their period of inactivity.

* The cost to the state of unemployment is not as great as something of value is recovered in return for benefits.

The argument really revolves around the idea that the unemployed are voluntarily unemployed to some extent. Some don't want jobs and others are waiting for the 'right job'. By making unemployment more costly (this includes falls in the value of benefits announced in the budget) by demanding more effort then those out of work are more likely to accept a job offered to them. This effectively shortens the period of unemployment and helps match people to vacancies more willingly.

The problem is that the economic research on this issue says that it does not work. The Saturday Paper reviews this topic below.

Sunday, 20 July 2014

Mining Resources Rent Tax is a good idea

The article below is by Ross Gittins and he explains why the MRRT is a good idea. A better designed tax would have raised more money and provided Australia with a Sovereign Wealth Fund to help maintain the standard of living of the country after the resources boom has passed.

Read and understand.

Read and understand.

Thursday, 10 July 2014

Unemployment up, but not all bad news

Unemployment rose last month, and has now reached 6%. This might seem a bad thing, but there were actually more full time jobs last month and the rise in employment exceeded expectations.

The reason for the rise in unemployment is due to a higher participation rate. This is encouraging because it means more people are seeking work and that indicates a degree of confidence in the economy.

The ABC article says it all. In particular look at the State unemployment data at the bottom of the article.

The reason for the rise in unemployment is due to a higher participation rate. This is encouraging because it means more people are seeking work and that indicates a degree of confidence in the economy.

The ABC article says it all. In particular look at the State unemployment data at the bottom of the article.

Wednesday, 9 July 2014

Reasons to keep the Carbon Tax

As the Senate does or does not vote to keep the Carbon Tax it is useful to remember that the Economics of Climate Change says a Carbon price is a good idea.

It is also worth remembering that the Australian governments issue is that it does not raise enough revenue, thanks to the reckless Costello budgets. Therefore why not tax something bad? It's better than income tax or Medicare co-payments.

It is also worth remembering that the Australian governments issue is that it does not raise enough revenue, thanks to the reckless Costello budgets. Therefore why not tax something bad? It's better than income tax or Medicare co-payments.

Thursday, 3 July 2014

The Economic consequences of Mr Abbott

Joe Stiglitz is possibly the economist who behaves most like Keynes in the modern era. He is never short of advice.

In his current visit to Australia he has been quick to point out the consequences of the current governments policy and he does not much like them.

This is directly relevant to Budgetary and Supply side policy for Unit 4.

In his current visit to Australia he has been quick to point out the consequences of the current governments policy and he does not much like them.

This is directly relevant to Budgetary and Supply side policy for Unit 4.

Labels:

Bugetary policy,

Fiscal Policy,

Supply-side policy

Wednesday, 25 June 2014

Regulation to reduce climate change

Yesterday Clive Palmer said he discovered things about the dangers of climate change from Al Gore that he had not known about. Leaving aside the obvious point that no politician who wishes to talk at length about the Carbon Tax should do so without knowing the facts, I also found out something about Australian policy yesterday.

Australia has no vehicle emission standards for cars and light goods vehicles. I knew Australia lagged behind the rest of the world on carbon pricing, emissions targets and CO2 per capita. However not to have rules on how much vehicles emit was a shock.

The good news is that it might happen soon. The Guardian tells the story and has the details of how effective it can be. Such regulation is one of the few examples of where a rule is better than a price to deal with market failure.

Remember when the idiot Abbott falsely claims the Carbon tax is 'the highest in the world' that the rest of the world has multiple climate change measures.

Australia has no vehicle emission standards for cars and light goods vehicles. I knew Australia lagged behind the rest of the world on carbon pricing, emissions targets and CO2 per capita. However not to have rules on how much vehicles emit was a shock.

The good news is that it might happen soon. The Guardian tells the story and has the details of how effective it can be. Such regulation is one of the few examples of where a rule is better than a price to deal with market failure.

Remember when the idiot Abbott falsely claims the Carbon tax is 'the highest in the world' that the rest of the world has multiple climate change measures.

Saturday, 21 June 2014

Australian policy on climate change remains confused

The Abbott government's climate change policy seems to be driven by two motives. They know that voters will reward them for lowering prices or taxes, regardless of the merits of the case. They also seem to want to reward big business, their principle financial supporters.

Prior to the Carbon Tax the Renewable Energy Target (RET's) was the principle climate change policy of Australia. The RET policy is 20% of electricity is to be generated from renewable sources by 2020. This policy requires subsidy from government as renewable energy currently costs more than energy from fossil fuel.

The Abbott government will almost certainly reduce the renewable energy requirement. However they have little support from the public for this as The Guardian reports below.

RET's are an important environmental policy and should be understood at VCE. It is a legitimate alternative policy to talk about in the exam and can be easier to describe than carbon pricing.

A useful statistic for those interested in climate change. Australia produces FIVE times as much carbon per person as their fair share (i.e. divide world CO2 emissions by 7 billion and multiply by 23.5 million to get the 'fair share' for Australia).

Prior to the Carbon Tax the Renewable Energy Target (RET's) was the principle climate change policy of Australia. The RET policy is 20% of electricity is to be generated from renewable sources by 2020. This policy requires subsidy from government as renewable energy currently costs more than energy from fossil fuel.

The Abbott government will almost certainly reduce the renewable energy requirement. However they have little support from the public for this as The Guardian reports below.

RET's are an important environmental policy and should be understood at VCE. It is a legitimate alternative policy to talk about in the exam and can be easier to describe than carbon pricing.

A useful statistic for those interested in climate change. Australia produces FIVE times as much carbon per person as their fair share (i.e. divide world CO2 emissions by 7 billion and multiply by 23.5 million to get the 'fair share' for Australia).

Thursday, 19 June 2014

Unfair practice? ACCC takes action against Jetstar and Virgin

When a market is an oligopoly the chances of tacit collusion is high. There are only a few airlines operating in the Australian domestic market and the ACCC believes they are operating unfairly.

The issue is the way the airlines advertise a price and then add fees as the booking progresses. The particular issue is how there is a charge for using normal methods of paying.

The ACCC is taking legal action because they feel that it is the low level of competition which is the cause of the problem.

The ACCC argument might be this. The airlines are deliberately hiding the fees to make them look more attractive to customers. Because the airlines know that they will both make more money by doing this they don't try to compete the fees away. If there was true competition then these high fees would be reduced as an airline started to advertise 'no hidden charges'.

It is the role of the ACCC to look for market failures due to monopoly power. In this case they may have a point. Customers are being mislead. However if the practise was stopped would the 'headline' airfare rise by the same amount?

The issue is the way the airlines advertise a price and then add fees as the booking progresses. The particular issue is how there is a charge for using normal methods of paying.

The ACCC is taking legal action because they feel that it is the low level of competition which is the cause of the problem.

The ACCC argument might be this. The airlines are deliberately hiding the fees to make them look more attractive to customers. Because the airlines know that they will both make more money by doing this they don't try to compete the fees away. If there was true competition then these high fees would be reduced as an airline started to advertise 'no hidden charges'.

It is the role of the ACCC to look for market failures due to monopoly power. In this case they may have a point. Customers are being mislead. However if the practise was stopped would the 'headline' airfare rise by the same amount?

Labels:

ACCC,

competition,

Market failure,

Monopoly power,

oligopoly

Wednesday, 18 June 2014

Business Confidence threatens growth

As we all know by now Business Confidence is a key determinant of Investment spending.

If Business Confidence falls, then Investment will likely fall and as this is a component of aggregate demand we can expect a fall in real GDP, or at least a slowing of economic growth.

The latest data suggests that Business Confidence is declining as there is greater uncertainty following the Federal Budget.

Note this fall in confidence is largely to do with uncertainty. It's not that the business community disliked all the Budget measures, rather they are unsure if those measures will get through the Senate. Predictably firms are also worried that the Carbon Tax will not be repealed as its abolition represents a boost to company profits.

If Business Confidence falls, then Investment will likely fall and as this is a component of aggregate demand we can expect a fall in real GDP, or at least a slowing of economic growth.

The latest data suggests that Business Confidence is declining as there is greater uncertainty following the Federal Budget.

Note this fall in confidence is largely to do with uncertainty. It's not that the business community disliked all the Budget measures, rather they are unsure if those measures will get through the Senate. Predictably firms are also worried that the Carbon Tax will not be repealed as its abolition represents a boost to company profits.

Thursday, 12 June 2014

Unemployment steady but the figure hides weakness

The latest unemployment figure shows that Australian unemployment stayed at 5.8% for a third month.

This can be seen as good and bad news depending on how you look at it.

The Fat Controller claimed the government had turned the economy around because unemployment was forecast to be 6.25% by now.(This seems unlikely in the timescale.)

Others see a problem. The continued fall in the participation rate means that there could be disguised unemployment. "If the participation rate had remained at its 2011 average level the unemployment rate would now be seven per cent,"

One explanation for the fall in the participation rate is the aging population. However the fall in this rate seems to be too rapid for that to be the only reason.

The economy is growing, but not creating many jobs. This is not unknown when an economy is recovering as those employed take up the slack. Hopefully this means that jobs will start to come soon.

This can be seen as good and bad news depending on how you look at it.

The Fat Controller claimed the government had turned the economy around because unemployment was forecast to be 6.25% by now.(This seems unlikely in the timescale.)

Others see a problem. The continued fall in the participation rate means that there could be disguised unemployment. "If the participation rate had remained at its 2011 average level the unemployment rate would now be seven per cent,"

One explanation for the fall in the participation rate is the aging population. However the fall in this rate seems to be too rapid for that to be the only reason.

The economy is growing, but not creating many jobs. This is not unknown when an economy is recovering as those employed take up the slack. Hopefully this means that jobs will start to come soon.

Sunday, 8 June 2014

Budget reflections

While we will look in detail at the Federal Budget in Unit 4 there is a continuing stream of comment that raises points to note.

Below is a link to Ross Gittins latest effort. (You need to remember he is a journalist not a trained economist and sometimes gets the wrong end of the stick.)

In this article he points out the extent of the measures in cutting expenditure, the reliance on bracket creep (fiscal drag) to raise revenue and the redistribution effect from poor to rich (goal of equity).

Perhaps his most important point is that the implications of this Budget is that in the not to distant future the measures would have to be reversed because the implications are so grave. Note his point on ideology are not for repeating in the exam.

Below is a link to Ross Gittins latest effort. (You need to remember he is a journalist not a trained economist and sometimes gets the wrong end of the stick.)

In this article he points out the extent of the measures in cutting expenditure, the reliance on bracket creep (fiscal drag) to raise revenue and the redistribution effect from poor to rich (goal of equity).

Perhaps his most important point is that the implications of this Budget is that in the not to distant future the measures would have to be reversed because the implications are so grave. Note his point on ideology are not for repeating in the exam.

The Gittins article is here

As an add on there is an excellent article in The Guardian that explains what the true level of Australia's national debt is. The article also explains the importance of using real figures as opposed to gross figures and using figures as a percentage of GDP when trying to properly understand the debt position.

There are some neat interactive graphs to play with too!

Wednesday, 4 June 2014

Economic news

There are several pieces of news to follow.

The RBA kept interest rates on hold at 2.5% on Tuesday. The RBA commented that the exchange rate remained high by historical standards implying they thought it would fall.

Consumer confidence moved up, just a little, but is still at 1990 recession levels.

The ABS reported that GDP rose 1.1% in the first three months of the year, and annual growth was at 3.5%. This is higher than expected but the government still expect the rate of growth this year to be 2.5% which suggests a torrid nine months ahead.

The Fair Work Commission has agreed a 3% rise in the minimum wage. This will add $18.70 to the weekly wage of a full-time worker.

Below are two articles that cover some of these items. Please read them for details.

Note that the rise in the minimum wage is a supply side factor and will influence the Aggregate Supply curve by moving it to the left. Also take careful not of the Fair Work Commission's view on equity in terms of income distribution in Australia.

The RBA kept interest rates on hold at 2.5% on Tuesday. The RBA commented that the exchange rate remained high by historical standards implying they thought it would fall.

Consumer confidence moved up, just a little, but is still at 1990 recession levels.

The ABS reported that GDP rose 1.1% in the first three months of the year, and annual growth was at 3.5%. This is higher than expected but the government still expect the rate of growth this year to be 2.5% which suggests a torrid nine months ahead.

The Fair Work Commission has agreed a 3% rise in the minimum wage. This will add $18.70 to the weekly wage of a full-time worker.

Below are two articles that cover some of these items. Please read them for details.

Note that the rise in the minimum wage is a supply side factor and will influence the Aggregate Supply curve by moving it to the left. Also take careful not of the Fair Work Commission's view on equity in terms of income distribution in Australia.

Thursday, 29 May 2014

Dollar movements highlight a 'patchwork economy'

The Australian dollar took a move upwards on seemingly bad news. Investment in capital goods was down.

The reason why the dollar got stronger was that investment in the manufacturing sector was up. An unexpected event. This is seen as good as Australia tries to get over dependence on the mining boom.

Not that long ago it was fashionable to talk about a 'two speed economy'. The mining sector forged ahead, driving overall GDP growth, while manufacturing shrank. It was more accurate to describe a 'multi-speed' or 'patchwork' economy as different states and industries met very different fortunes.

So this is good news of sorts, but still points to an overall downward trend in Investment (a component of Aggregate Demand).

The story does help us understand important influences on the exchange rate. To understand why the exchange rate changes on this news is important:

1. The exchange rate is determined by the demand for and supply of the Australian dollar.

2. A major reason to demand Australian dollars is to buy iron ore (Australia's largest export) and the price of iron ore has fallen 28% in the last year. Therefore buyers need fewer dollars and so demand for dollars falls.

3. Another reason to buy dollars is to invest in Australian businesses. If an economy is growing strongly the chance making a profit is higher.

4. The new figures on investment in manufacturing imply that Australia will grow faster than was previously expected.

5. Therefore confidence in Australian future profits has risen, this will mean greater demand for investing in Australia in the future, and so the demand for dollars rises now.

6. Demand for Australian dollars rises now because some speculators will expect the dollar to be worth more in the future and they seek to buy dollars now to make a profit reselling them later.

It's easier on a diagram!

The reason why the dollar got stronger was that investment in the manufacturing sector was up. An unexpected event. This is seen as good as Australia tries to get over dependence on the mining boom.

Not that long ago it was fashionable to talk about a 'two speed economy'. The mining sector forged ahead, driving overall GDP growth, while manufacturing shrank. It was more accurate to describe a 'multi-speed' or 'patchwork' economy as different states and industries met very different fortunes.

So this is good news of sorts, but still points to an overall downward trend in Investment (a component of Aggregate Demand).

The story does help us understand important influences on the exchange rate. To understand why the exchange rate changes on this news is important:

1. The exchange rate is determined by the demand for and supply of the Australian dollar.

2. A major reason to demand Australian dollars is to buy iron ore (Australia's largest export) and the price of iron ore has fallen 28% in the last year. Therefore buyers need fewer dollars and so demand for dollars falls.

3. Another reason to buy dollars is to invest in Australian businesses. If an economy is growing strongly the chance making a profit is higher.

4. The new figures on investment in manufacturing imply that Australia will grow faster than was previously expected.

5. Therefore confidence in Australian future profits has risen, this will mean greater demand for investing in Australia in the future, and so the demand for dollars rises now.

6. Demand for Australian dollars rises now because some speculators will expect the dollar to be worth more in the future and they seek to buy dollars now to make a profit reselling them later.

It's easier on a diagram!

Tuesday, 20 May 2014

Dive, dive, dive!

The Federal Budget has, as expected, had an affect on Consumer Confidence (sentiment). However the hit is far greater than was anticipated.

One measure has consumer confidence declining by 14% in the latest four week period.

The Westpac-Melbourne Institute measure of Consumer Confidence also fell. Westpac's Chief Economist, Bill Evans, commented, "The sharp fall in the Index is clearly indicating an unfavourable response to the recent Federal Budget. This puts the Index at its lowest level since August 2011, before the Reserve Bank began its recent rate cut cycle."

The diagram shows the Westpac-Melbourne Institute data, issued today.

This is important because as Consumers Expenditure is the largest component of Aggregate Demand this is likely to affect the real economy. When confidence falls households reduce spending (raise saving) and this knocks on to the real economy as the AD curve shifts to the left.

This is an early indication of confidence and it will probably rebound when people get over the shock of the Budget. However the overall effect will still be to depress AD for the rest of the year with the inevitable consequences for output and employment and, of course, business confidence.

One measure has consumer confidence declining by 14% in the latest four week period.

The Westpac-Melbourne Institute measure of Consumer Confidence also fell. Westpac's Chief Economist, Bill Evans, commented, "The sharp fall in the Index is clearly indicating an unfavourable response to the recent Federal Budget. This puts the Index at its lowest level since August 2011, before the Reserve Bank began its recent rate cut cycle."

This is important because as Consumers Expenditure is the largest component of Aggregate Demand this is likely to affect the real economy. When confidence falls households reduce spending (raise saving) and this knocks on to the real economy as the AD curve shifts to the left.

This is an early indication of confidence and it will probably rebound when people get over the shock of the Budget. However the overall effect will still be to depress AD for the rest of the year with the inevitable consequences for output and employment and, of course, business confidence.

Labels:

Aggregate demand,

Australian Data VCE Economics,

Budget 2014,

Consumer Confidence,

Federal Budget

Tuesday, 13 May 2014

Not a shock, but a shocker.

Below are a couple of links which give easy to digest details on last nights Federal Budget.

I will deal with individual measures in individual posts. It is often best to hold fire on these things as the budget speech gives few details and nasty things are often hidden on page 350 of the document and take time to come out!

The things we need to think about are how the Budget impacts on the economic goals and the standard of living. Understanding the philosophy of the budget also helps a lot to get the idea.

Saturday, 10 May 2014

Inequality - a key goal that always gets a low priority?

The VCE study design insists that equity is a goal of government policy. In Australia it has always been a matter of pride that income distribution is more equal than other developed countries, but since the 1980's policy measures have not really backed that up.

The coming Federal Budget is likely to make the distribution of income less equal, particularly if the petrol excise duty and GP visit co-payment is introduced. However the discussion of the Budget will be dominated by its affects on other goals I suspect, so dealing with it now might be opportune.

Inequality is measured by the Gini co-efficient. The table below showshow Australia compared in the 'late 2000's'. Although a Gini co-efficient of 0.33 isn't too bad at all compared to the 1980's it is about 20% more unequal (Australia would have been in around the same position as Hungary on this graph.

The coming Federal Budget is likely to make the distribution of income less equal, particularly if the petrol excise duty and GP visit co-payment is introduced. However the discussion of the Budget will be dominated by its affects on other goals I suspect, so dealing with it now might be opportune.

Inequality is measured by the Gini co-efficient. The table below showshow Australia compared in the 'late 2000's'. Although a Gini co-efficient of 0.33 isn't too bad at all compared to the 1980's it is about 20% more unequal (Australia would have been in around the same position as Hungary on this graph.

The article below from The Age explains the likely impact of a number of proposed Budget measures. We shall return to them when we look at the goal of equality later.

Thursday, 8 May 2014

Unemployment steady, but what next?

In a surprise set of figures Australia's unemployment rate remained at 5.8%. Many expected a rise after last months surprise fall.

There were over 14,000 new jobs created and unemployment actually fell a little (by 400). However the participation rate fell again and this indicates that more people 'left' the workforce as they stopped looking for work.

The table below is from the ABS.

There were over 14,000 new jobs created and unemployment actually fell a little (by 400). However the participation rate fell again and this indicates that more people 'left' the workforce as they stopped looking for work.

The table below is from the ABS.

When looking at the figures concentrate on trends. These are over the last year, rising employment, steady/falling unemployment and a falling participation rate. These can be seen in the last column.

The question of where unemployment goes next is a big one. The two articles below, both from the Sydney Morning Herald, take opposite lines. One says unemployment may have peaked, the other that the next two years will see much higher unemployment.

ust

Look at the factors each article considers is driving employment. this is a classic 'headwinds' and 'tailwinds' situation. Some factors are pushing the economy one way and some the other. You must be aware of these different factors.

Monday, 5 May 2014

Debt levy looks less and less likely

The Commission of Audit and the government have now scared the population half to death with the prospect of expenditure cuts and tax rises. That was probably their point. whatever the Federal Budget delivers next week will be a relief and might actually lead to a rise in government support which has been battered in the last few weeks.

I remain astounded that the government can still claim a budget crisis and base their policy on the need to fix it. There are three important points we need to consider:

1. The deficit forecast is based on low growth forecasts which depress tax revenues.

2. The government continues to lump capital spending in with current spending when reporting the deficit.

3. Governments are not households and don't have to follow the same rules on borrowing.

The first point means that the deficit crisis is political. Using assumptions which suit their economic case is an old political trick.

The second and third points are related. Most governments try to balance their current spending over the economic cycle. Borrow in the bad years and repay in the good. That's a pretty safe fiscal strategy.

However all governments have the responsibility to invest in infrastructure and capital projects that aid the economy to become more productive and provide the public and merit goods needed to maintain and improve the standard of living. Such projects such as railways, the NBN and hospitals are used for years. They should be paid for by loans that are repaid by the future users, not current tax payers.

When the capital items are taken out of the budget the deficit looks very manageable.

I will deal with the desirability of managing economic activity in a later post, but for now consider that the deficit is a tool to manage the level of activity.

All this talk of taxes and expenditure cuts is dangerous in itself. A key part of Aggregate Demand is Consumption and this relies not only on income levels but also consumer confidence. Scare the households enough and they will react instinctively to the uncertainty and save more. This will reduce consumption, a component of Aggregate Demand, and so lower the level of economic activity.

A similar argument can be made for business confidence and investment, also a component of Aggregate Demand.

Below is a link to a Guardian article where former Liberal Treasurer Peter Costello says a deficit tax won't work and the head of the Commission of Audit says it will do harm.

I remain astounded that the government can still claim a budget crisis and base their policy on the need to fix it. There are three important points we need to consider:

1. The deficit forecast is based on low growth forecasts which depress tax revenues.

2. The government continues to lump capital spending in with current spending when reporting the deficit.

3. Governments are not households and don't have to follow the same rules on borrowing.

The first point means that the deficit crisis is political. Using assumptions which suit their economic case is an old political trick.

The second and third points are related. Most governments try to balance their current spending over the economic cycle. Borrow in the bad years and repay in the good. That's a pretty safe fiscal strategy.

However all governments have the responsibility to invest in infrastructure and capital projects that aid the economy to become more productive and provide the public and merit goods needed to maintain and improve the standard of living. Such projects such as railways, the NBN and hospitals are used for years. They should be paid for by loans that are repaid by the future users, not current tax payers.

When the capital items are taken out of the budget the deficit looks very manageable.

I will deal with the desirability of managing economic activity in a later post, but for now consider that the deficit is a tool to manage the level of activity.

All this talk of taxes and expenditure cuts is dangerous in itself. A key part of Aggregate Demand is Consumption and this relies not only on income levels but also consumer confidence. Scare the households enough and they will react instinctively to the uncertainty and save more. This will reduce consumption, a component of Aggregate Demand, and so lower the level of economic activity.

A similar argument can be made for business confidence and investment, also a component of Aggregate Demand.

Below is a link to a Guardian article where former Liberal Treasurer Peter Costello says a deficit tax won't work and the head of the Commission of Audit says it will do harm.

Saturday, 3 May 2014

A lower minimum wage?

The Commission of Audit, despite a poor overall analysis, suggests many sensible individual policy measures. One is the need to lower the relative level of the minimum wage.

The Commission suggest that the minimum wage should fall to 44% of the average full time wage, from the current 56%. They argue that it is currently too high to encourage employment and growth.

The standard argument is shown below.

The minimum wage is set above the market clearing rate. This encourages Q1-Q2 additional workers to seek work when they wouldn't at the market wage rate of 0W1. Also Q2-Q3 workers are not employed who would be at the market wage rate. Unemployment is reported at Q1-Q3.

Of course the argument for a minimum wage is that without it workers would receive a lower wage than 0W1 due to the relatively greater negotiating power of employers compared to employees. (The free market is failing due to market power.)

The Guardian article below outlines the case of the Audit Commission. They believe that it will help achieve full employment and future growth. However will lowering the minimum wage help the goal of equity?

Although Australia does have an absolutely high and relatively high minimum wage rate it is falling as a percentage of full time income compared to other OECD nations. When PPP is used it also looks more reasonable in comparison.

The Commission suggest that the minimum wage should fall to 44% of the average full time wage, from the current 56%. They argue that it is currently too high to encourage employment and growth.

The standard argument is shown below.

The minimum wage is set above the market clearing rate. This encourages Q1-Q2 additional workers to seek work when they wouldn't at the market wage rate of 0W1. Also Q2-Q3 workers are not employed who would be at the market wage rate. Unemployment is reported at Q1-Q3.

Of course the argument for a minimum wage is that without it workers would receive a lower wage than 0W1 due to the relatively greater negotiating power of employers compared to employees. (The free market is failing due to market power.)

The Guardian article below outlines the case of the Audit Commission. They believe that it will help achieve full employment and future growth. However will lowering the minimum wage help the goal of equity?

Although Australia does have an absolutely high and relatively high minimum wage rate it is falling as a percentage of full time income compared to other OECD nations. When PPP is used it also looks more reasonable in comparison.

Labels:

Commission of Audit,

Economic growth,

Equity,

Full Employment,

Macroeconomic objectives,

Minimum wage,

Unemployment,

VCE Economics

Thursday, 1 May 2014

Commission of Audit Report

I think that the Commission of Audit have been knobbled. I have not read all of their 1000 page report yet but what I have seen is clearly based on poor logic and terms of reference that presupposed the answer. I have never seen a sloppier piece of work from a government commission.

The Commission suggest privatising major parts of government, letting States run services rather than to complicated Federal/State mix that exists at present and duplicates in part and capping the Paid Parental Leave scheme. All three suggestions seem quite sensible.

However they also suggest reducing pension entitlement, cutting back on the National Disability Insurance Scheme, Co-payments on many medicare services and medications on PBS, reducing education spending as a proportion of GDP and reducing assistance for agriculture. There are other measures too. All of these seem to be a drastic attempt to cut spending.

The problem is that they base their arguments of a false premise and their own figures show that if nothing was done there isn't actually a problem.

Twice in the first pages the Commission asserts that 'Households cannot live beyond their means. Government's shouldn't either.' This was an argument much loved by Margaret Thatcher, but she knew it was based on a false analogy.

Governments, which persist forever, never retire and have credit ratings that allow persistent borrowing, are not households. You cannot make rules for the crowd based on what works for an individual. It's like saying, 'If I stand on tip toe I will see the parade better.' Except if everyone does that nobody sees better and everyone gets sore feet.

If a household borrows too much they will be overwhelmed by debt, but governments can borrow persistently and as long as economic growth is as high as the the level of borrowing (as a percentage of GDP) then the debt burden as a share of GDP won't rise. The interest burden remains manageable.

The Commission reports that it looked at a 'Business as usual' scenario and reports that the deficit by 2023/24 would be just 1.5% of GDP. That's half what it is now.

To make matters worse the Commission assume that tax receipts will flatten out. This is because they assume that the government in the future won't allow taxes to rise. This alone completely changes the expected budget outcome and is used to justify cuts. Clearly the Commission is manipulating the results to suit the Government's agenda.

The Commission, by its own admission, can't count (they claim $6,000 to $15,000 is a trebling of the figure) so we might have to treat their figures carefully. However they also show that the tax burden has hardly changed from forty years ago while real government spending has trebled (see above). They seem to prove the point that what is needed is economic growth.

The Commission suggest privatising major parts of government, letting States run services rather than to complicated Federal/State mix that exists at present and duplicates in part and capping the Paid Parental Leave scheme. All three suggestions seem quite sensible.

However they also suggest reducing pension entitlement, cutting back on the National Disability Insurance Scheme, Co-payments on many medicare services and medications on PBS, reducing education spending as a proportion of GDP and reducing assistance for agriculture. There are other measures too. All of these seem to be a drastic attempt to cut spending.

The problem is that they base their arguments of a false premise and their own figures show that if nothing was done there isn't actually a problem.

Twice in the first pages the Commission asserts that 'Households cannot live beyond their means. Government's shouldn't either.' This was an argument much loved by Margaret Thatcher, but she knew it was based on a false analogy.

Governments, which persist forever, never retire and have credit ratings that allow persistent borrowing, are not households. You cannot make rules for the crowd based on what works for an individual. It's like saying, 'If I stand on tip toe I will see the parade better.' Except if everyone does that nobody sees better and everyone gets sore feet.

If a household borrows too much they will be overwhelmed by debt, but governments can borrow persistently and as long as economic growth is as high as the the level of borrowing (as a percentage of GDP) then the debt burden as a share of GDP won't rise. The interest burden remains manageable.

The Commission reports that it looked at a 'Business as usual' scenario and reports that the deficit by 2023/24 would be just 1.5% of GDP. That's half what it is now.

To make matters worse the Commission assume that tax receipts will flatten out. This is because they assume that the government in the future won't allow taxes to rise. This alone completely changes the expected budget outcome and is used to justify cuts. Clearly the Commission is manipulating the results to suit the Government's agenda.

The Commission, by its own admission, can't count (they claim $6,000 to $15,000 is a trebling of the figure) so we might have to treat their figures carefully. However they also show that the tax burden has hardly changed from forty years ago while real government spending has trebled (see above). They seem to prove the point that what is needed is economic growth.

Monday, 28 April 2014

The economics of Medicare co-payments

It seems likely that the Federal Budget will introduce a $6 charge for visiting the GP when bulk billing is the way the GP is paid. In other words the patient hands over $6 when they visit.

The aim of the measure is to reduce the cost of Medicare to the government. There are two reasons the government want to do this:

1. To reduce expenditure and so reduce the budget deficit.

2. To offset rising Medicare expenditure.

The second reason is the one which needs explaining. As the population of Australia gets older on average there will be greater calls on medical services. Old people get ill more often and medical science finds more and more ways to keep people alive. That's great for the people, but expensive for Medicare.

The problem with free GP visits is that some of them are not necessary, or benefit the patient little. The aim of the co-payment is not so much to raise money as to cut out some of these visits.

The aim of the measure is to reduce the cost of Medicare to the government. There are two reasons the government want to do this:

1. To reduce expenditure and so reduce the budget deficit.

2. To offset rising Medicare expenditure.

The second reason is the one which needs explaining. As the population of Australia gets older on average there will be greater calls on medical services. Old people get ill more often and medical science finds more and more ways to keep people alive. That's great for the people, but expensive for Medicare.

The problem with free GP visits is that some of them are not necessary, or benefit the patient little. The aim of the co-payment is not so much to raise money as to cut out some of these visits.

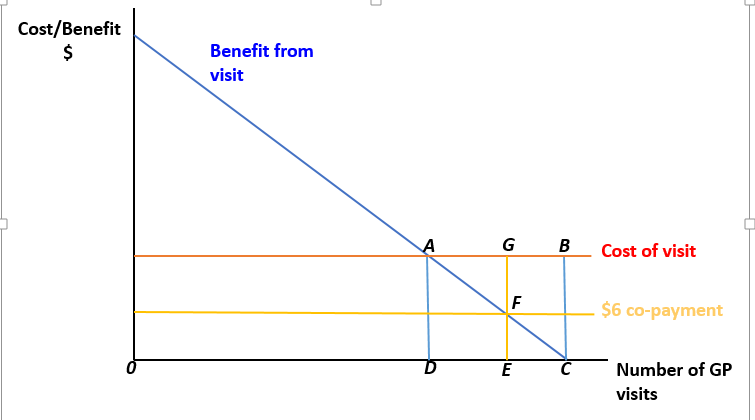

The diagram shows the demand for GP visits. When there is no charge to visit the GP then there will be 0C visits.

The problem is the cost of providing the GP service for all visits over 0D is greater than the benefit gained. (The benefit may be gained by the patient or society as a whole.)

For simplicity I am assuming all GP visits cost the same amount. The benefits of each visit vary, some contain infectious diseases and save lives, however some might simply need the advice of a pharmacist and add little benefit.

The GP visits D to C cost the Medicare system ABCD (price x quantity) to provide, but only benefit society by the amount ACD.

So the logic of the co-payment is this. By introducing the $6 charge E to C visits are perceived by the patient to be not worth the expense. The patients lose the benefit FEC. However the government save the cost GBEC, a substantially greater saving for the benefit lost.

The drawbacks of the co-payment system are obvious. here are just two:

1. The system is regressive. As the lowest paid will pay the same as the best paid the $6 represents a higher percentage of their income. This affects the goal of equality.

2. As health care is an imperfect information good patients are not well placed to decide if going to the doctor is a sensible thing. Some will keep the $6 and miss the chance of the early diagnosis and treatment of a serious illness.

Labels:

Budget,

Budget 2014,

Co-payment,

Imperfect information goods,

Medicare,

Merit goods.,

Regressive taxation

Saturday, 26 April 2014

Hockey's case on economy shown to be politics, not economics

Andrew Neil, a right wing journalist from the UK, interviewed Joe Hockey last week. here are a couple of Youtube clips about the interview.

Hockey does not generally submit to interviews and comes off very badly when pressed by Neil, one of a number of top class interviewers in the UK known for getting answers out of people. Hockey's media people obviously didn't know about the trick of having the interviewers microphone set louder than the interviewee!

Neil establishes that Australia is doing better than any other G20 country and that it is difficult to justify claims of a crisis.

Hockey does not generally submit to interviews and comes off very badly when pressed by Neil, one of a number of top class interviewers in the UK known for getting answers out of people. Hockey's media people obviously didn't know about the trick of having the interviewers microphone set louder than the interviewee!

Neil establishes that Australia is doing better than any other G20 country and that it is difficult to justify claims of a crisis.

On Lateline later Neil answered questions and gives some credit to the Treasurer's case but still puts it into context. He moves away from the Budget as the interview continues.

Friday, 25 April 2014

'Final' Direct Action plans published

The government have published their final White Paper on how Direct Action will replace the Carbon Tax.

The idea of direct action is that companies will 'bid' for contracts that will allow them to introduce measures to reduce carbon emissions. The government claim that they will meet the 5% reduction target in carbon emissions by 2020 as a result.

Very few people have any confidence that this new scheme will work. Economists have a very clear view on the effectiveness of various schemes to reduce negative externalities.

The idea of direct action is that companies will 'bid' for contracts that will allow them to introduce measures to reduce carbon emissions. The government claim that they will meet the 5% reduction target in carbon emissions by 2020 as a result.

Very few people have any confidence that this new scheme will work. Economists have a very clear view on the effectiveness of various schemes to reduce negative externalities.

BEST

Permit trading schemes

Tax

Regulation

Nothing

WORST

The Direct Action scheme counts as regulation. Perhaps the kindest thing that can be said about it is that it is better than nothing.

The problem of regulation is that it relies on somebody deciding the amount of reduction and/or the budget for the regulation. Neither will be necessarily the optimal (allocatively efficient) amount and are likely to be restricted by both budgets and political constraints.

The advantage of both tax and trading schemes is that they rely on the market and can be managed so that the economy adjusts to the socially optimal position. Both have the weakness that negative externalities must be well understood to achieve their goal.

However trading schemes have the huge advantage of allowing the cheapest possible reduction in negative externalities. By this standard Direct Action comes a very poor third in reducing carbon emissions.

Labels:

Carbon Tax,

Carbon trading,

Direct action,

Global warming,

Negative externalities,

Regulation

Wednesday, 23 April 2014

Better than expected inflation figure triggers significant reaction

Inflation is reported to be at 2.9% on the headline rate and 2.7% on the underlying rate. This is less than expected and has been a cause for relief for the RBA.

The RBA have a target range of 2 to 3% inflation. The widespread expectation was that headline inflation would rise to about 3.2% for the quarter to March and that this would cause the central bank to raise interest rates from their current low to reduce inflation.

The relief is on two counts.

1. A rise in interest rates would cause lower discretionary income for households and reduce Consumption. Also it would reduce Investment by firms which are sensitive to the cost of borrowing. Both are components of Aggregate Demand.

2. The exchange rate would likely rise as interest rates rose (Australia already has very high interest rates compared to the other industrialised economies). This would make exports more expensive and imports cheaper and stifle the export led growth on which much relies.

The news led to a sharp fall in the value of the Aus$ (by around 0.75 cents against the US$). This was due to traders lowering their expectations on the possibility of a rate rise.

It is well worth looking at the ABS statistics which can be accessed in the links section (key data).

The likelihood is that rates will stay on hold for the rest of the year. This is good as business and consumers like stability. It gives them confidence and they can plan their next moves.

It is, however, unlikely that even 3.2% inflation would be the cause of a rise in rates. The RBA knows that it takes two years for interest rate changes to work through the economy to reduce inflation. They will be looking at the longer term forces affecting inflation over those two years when deciding on interest rate changes. So rates may rise anyway!

The RBA have a target range of 2 to 3% inflation. The widespread expectation was that headline inflation would rise to about 3.2% for the quarter to March and that this would cause the central bank to raise interest rates from their current low to reduce inflation.

The relief is on two counts.

1. A rise in interest rates would cause lower discretionary income for households and reduce Consumption. Also it would reduce Investment by firms which are sensitive to the cost of borrowing. Both are components of Aggregate Demand.

2. The exchange rate would likely rise as interest rates rose (Australia already has very high interest rates compared to the other industrialised economies). This would make exports more expensive and imports cheaper and stifle the export led growth on which much relies.

The news led to a sharp fall in the value of the Aus$ (by around 0.75 cents against the US$). This was due to traders lowering their expectations on the possibility of a rate rise.

It is well worth looking at the ABS statistics which can be accessed in the links section (key data).

The likelihood is that rates will stay on hold for the rest of the year. This is good as business and consumers like stability. It gives them confidence and they can plan their next moves.

It is, however, unlikely that even 3.2% inflation would be the cause of a rise in rates. The RBA knows that it takes two years for interest rate changes to work through the economy to reduce inflation. They will be looking at the longer term forces affecting inflation over those two years when deciding on interest rate changes. So rates may rise anyway!

Signpost to 2014 budget

The Treasurer, Joe hockey, spoke last night about likely measures in the 2014 budget and his vision of the future for public finances.

The Budget is a major issue for the exam and understanding the philosophy of the budget measures is important. His speech last night gave important clues to this and it is useful to get a head start on that before the mind-numbing detail of the actual budget itself.

Hockey is concerned that government spending is growing in an unsustainable way and that this will lead to a growing structural budget deficit in the future. It's simple, if spending always grows faster than revenue then this will happen.

Note that most countries are envious of Australia's public finances. Australia has a low level of public debt and a low borrowing requirement as a share of GDP compared with other developed countries.

That isn't what Hockey is worried about despite his attempt to persuade people there is a 'Budget crisis'. That's just politics.

Hockey is worried that unless the projected rise in spending is brought down then taxes will have to rise in the future to balance the budget.

He may be right. Australia's public spending rises by about 3.75% a year. If growth is less than 3.75% and tax rates stay the same then the budget deficit will widen.

Some question the need to act drastically now. Growth could easily exceed 3.75% and 'bracket creep' would actually raise tax revenues faster than that. Government's would however be foolish to rely on that rate of growth.

Actually what Hockey is saying is that the growth years are over for Australia. Australia is a low productivity, high cost developed country which has lived off natural resource income while the comparative situation got worse. He also knows that an ageing population is going to put more strain on welfare spending over the next few decades. He is saying 'Winter is coming'.

The Budget is a major issue for the exam and understanding the philosophy of the budget measures is important. His speech last night gave important clues to this and it is useful to get a head start on that before the mind-numbing detail of the actual budget itself.

Hockey is concerned that government spending is growing in an unsustainable way and that this will lead to a growing structural budget deficit in the future. It's simple, if spending always grows faster than revenue then this will happen.

Note that most countries are envious of Australia's public finances. Australia has a low level of public debt and a low borrowing requirement as a share of GDP compared with other developed countries.

That isn't what Hockey is worried about despite his attempt to persuade people there is a 'Budget crisis'. That's just politics.

Hockey is worried that unless the projected rise in spending is brought down then taxes will have to rise in the future to balance the budget.

He may be right. Australia's public spending rises by about 3.75% a year. If growth is less than 3.75% and tax rates stay the same then the budget deficit will widen.

Some question the need to act drastically now. Growth could easily exceed 3.75% and 'bracket creep' would actually raise tax revenues faster than that. Government's would however be foolish to rely on that rate of growth.

Actually what Hockey is saying is that the growth years are over for Australia. Australia is a low productivity, high cost developed country which has lived off natural resource income while the comparative situation got worse. He also knows that an ageing population is going to put more strain on welfare spending over the next few decades. He is saying 'Winter is coming'.

Sunday, 13 April 2014

"Stop using fossil fuels" - IPCC

The IPCC have published their findings on what must be done to prevent the worst effects of climate change. They say the worst polluting fossil fuels must stop being used as soon as possible and renewable energy used instead.

What this really means is that fuels like brown coal, the dirtiest fuel, should be replaced with new capacity built in renewable energy such as wind and solar. They warn that if carbon emissions are not reduced radically by 2050 then it will be necessary to move into 'negative carbon emissions' after that.

They suggest that if action is taken now the cost will be small. They estimate about 0.1% of GDP per year. Whatever is done energy will cost more than it does today and, frankly, people will just have to suck it up.

Renewable energy is more expensive than energy from fossil fuel. However the external costs of using fossil fuel far outweigh the additional private costs of switching to renewable fuel. The problem is that the external costs fall on future generations and this allows climate criminals, such as the idiot Abbot, to use cheap debating tricks to convince people that there is no need to take urgent action on this matter for short-term political gain.

On the bright side the IPCC point out that there are more immediate external benefits of moving away from fossil fuels. These are all due to lower pollution levels and so better health.

Australia is so far behind the rest of the world on this matter it is difficult to imagine any leadership on this issue. Carbon pricing remains the most efficient way to tackle the problem and nuclear energy the most obvious short-term replacement for fossil fuels. The rest of the world will have to wait until after the next election for any help from Australia.

What this really means is that fuels like brown coal, the dirtiest fuel, should be replaced with new capacity built in renewable energy such as wind and solar. They warn that if carbon emissions are not reduced radically by 2050 then it will be necessary to move into 'negative carbon emissions' after that.

They suggest that if action is taken now the cost will be small. They estimate about 0.1% of GDP per year. Whatever is done energy will cost more than it does today and, frankly, people will just have to suck it up.

Renewable energy is more expensive than energy from fossil fuel. However the external costs of using fossil fuel far outweigh the additional private costs of switching to renewable fuel. The problem is that the external costs fall on future generations and this allows climate criminals, such as the idiot Abbot, to use cheap debating tricks to convince people that there is no need to take urgent action on this matter for short-term political gain.

On the bright side the IPCC point out that there are more immediate external benefits of moving away from fossil fuels. These are all due to lower pollution levels and so better health.

Australia is so far behind the rest of the world on this matter it is difficult to imagine any leadership on this issue. Carbon pricing remains the most efficient way to tackle the problem and nuclear energy the most obvious short-term replacement for fossil fuels. The rest of the world will have to wait until after the next election for any help from Australia.

Labels:

Climate change,

External benefits,

External costs,

Global warming,

Market failure,

Negative externalities,

Private costs

Tuesday, 8 April 2014

The Standard of Living

Pretty much everything in VCE Economics comes back to the standard of living. What this means is a difficult thing to pin down.

What we do know is:

* GDP alone is a poor indicator.

* Real GDP per capita using PPP is a much better one, but misses critical issues.

* The Human Development Index includes important additional factors and can be used to compare and monitor changing living standards.

However there isn't a perfect measure as non-material living standards are very difficult to measure and very different across nations.

The Social Progress Index tries to monitor living standards using a wide range of indicators. Australia still does well, but comes 10th (rather than 2nd in some HDI rankings). The 2014 data is linked below and it is well worth a look to try and grasp what standard of living really means and what can affect it.

What we do know is:

* GDP alone is a poor indicator.

* Real GDP per capita using PPP is a much better one, but misses critical issues.

* The Human Development Index includes important additional factors and can be used to compare and monitor changing living standards.

However there isn't a perfect measure as non-material living standards are very difficult to measure and very different across nations.

The Social Progress Index tries to monitor living standards using a wide range of indicators. Australia still does well, but comes 10th (rather than 2nd in some HDI rankings). The 2014 data is linked below and it is well worth a look to try and grasp what standard of living really means and what can affect it.

Monday, 7 April 2014

When is free trade not free trade?

Australia has 'concluded a free trade deal with Japan' and will sign another one with South Korea in the next two days. This is an important step forward, but isn't properly free trade.

In the eighteenth century Adam Smith, and in the nineteenth David Ricardo, showed that everybody gains from free trade. Economists have accepted this ever since. It is therefore astounding that any country retains barriers to trade in the twentyfirst century. However some do and so do Australia and Japan after this deal.

There is abolition of tariffs on some goods. Cars from Japan to Australia, for example, will fall from a 5% tariff to zero. But not necessarily all at once. Other tariffs are merely reduced, such as the tariff on beef from Australia to Japan, which was an eyewateringly high 38.5% will be halved. A 19.5% tax is still huge as a barrier to trade.

Tariffs are not the only barrier to trade. Quota's used to be a popular way to reduce trade and the new deal allows an additional 20,000 tonnes of Australian cheese to be exported to Japan. Another popular barrier to trade is to extol the benefits of local products. Australia is a master of this is their 'Australian owned' or 'Australian made' propaganda.

The simple fact of the matter is that all trade barriers harm the standard of living of countries. What protection (or economic nationalism as it is often called today) does is raise the prices paid by consumers and protects inefficient domestic producers from competition. Competition forces down costs and promotes allocative and technical (productive) efficiency.

Australia suffers more than most developed countries from the protectionist fallacy. People buy into the idea that local jobs are 'saved' by it. All protection can do is delay the inevitable and, usually, when the trade barriers are removed the domestic industry is so hopelessly inefficient it closes. Ask Ford, Holden and Toyota if you need proof of this.

In the eighteenth century Adam Smith, and in the nineteenth David Ricardo, showed that everybody gains from free trade. Economists have accepted this ever since. It is therefore astounding that any country retains barriers to trade in the twentyfirst century. However some do and so do Australia and Japan after this deal.

There is abolition of tariffs on some goods. Cars from Japan to Australia, for example, will fall from a 5% tariff to zero. But not necessarily all at once. Other tariffs are merely reduced, such as the tariff on beef from Australia to Japan, which was an eyewateringly high 38.5% will be halved. A 19.5% tax is still huge as a barrier to trade.

Tariffs are not the only barrier to trade. Quota's used to be a popular way to reduce trade and the new deal allows an additional 20,000 tonnes of Australian cheese to be exported to Japan. Another popular barrier to trade is to extol the benefits of local products. Australia is a master of this is their 'Australian owned' or 'Australian made' propaganda.

The simple fact of the matter is that all trade barriers harm the standard of living of countries. What protection (or economic nationalism as it is often called today) does is raise the prices paid by consumers and protects inefficient domestic producers from competition. Competition forces down costs and promotes allocative and technical (productive) efficiency.

Australia suffers more than most developed countries from the protectionist fallacy. People buy into the idea that local jobs are 'saved' by it. All protection can do is delay the inevitable and, usually, when the trade barriers are removed the domestic industry is so hopelessly inefficient it closes. Ask Ford, Holden and Toyota if you need proof of this.

Labels:

Allocative efficiency,

Free trade,

Protection,

Quota,

Standard of Living,

Tariffs,

Technical efficiency

Wednesday, 2 April 2014

Time to start the debate on tax?

The government worries about the size of the budget deficit and is going to take steps in the Budget to fix that. The problem is that short term changes won't fix a long term structural problem.

There are two ways to balance a budget.

1. Cut government spending

2. Raise more revenue through taxes.

Let us suppose that over time a government aims to balance its budget. That is it spends as much as it raises so there is no net addition to the national debt.

This does not mean that in each financial year the government will balance its budget. It actually means in years of low economic activity they will borrow (to boost the level of national output) and in the years at the top of the economic cycle they will run a surplus to repay debt. The result is a balanced budget over the economic cycle.

The problem for Australia is that they are borrowing in most years, resulting in a budget deficit over the economic cycle (known as a structural budget deficit). Although as the chart below shows Australia has no real debt problem compared to other nations.

Australia does not tax its citizens much either when compared to other developed countries (26.5% of GDP compared to an OECD average of 34.1% in 2012). It also has a fantastically complicated tax system which sees most people getting tax rebates each year.

A solution is to expand the tax base by taxing more things and doing this in a simple, non-refundable way. That is by taxing spending, not income. In Australia this is done by using the Goods and Services Tax (GST).