The aim of the measure is to reduce the cost of Medicare to the government. There are two reasons the government want to do this:

1. To reduce expenditure and so reduce the budget deficit.

2. To offset rising Medicare expenditure.

The second reason is the one which needs explaining. As the population of Australia gets older on average there will be greater calls on medical services. Old people get ill more often and medical science finds more and more ways to keep people alive. That's great for the people, but expensive for Medicare.

The problem with free GP visits is that some of them are not necessary, or benefit the patient little. The aim of the co-payment is not so much to raise money as to cut out some of these visits.

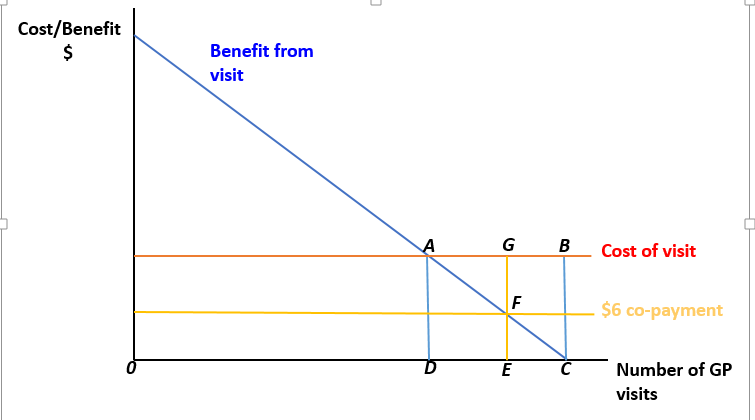

The diagram shows the demand for GP visits. When there is no charge to visit the GP then there will be 0C visits.

The problem is the cost of providing the GP service for all visits over 0D is greater than the benefit gained. (The benefit may be gained by the patient or society as a whole.)

For simplicity I am assuming all GP visits cost the same amount. The benefits of each visit vary, some contain infectious diseases and save lives, however some might simply need the advice of a pharmacist and add little benefit.

The GP visits D to C cost the Medicare system ABCD (price x quantity) to provide, but only benefit society by the amount ACD.

So the logic of the co-payment is this. By introducing the $6 charge E to C visits are perceived by the patient to be not worth the expense. The patients lose the benefit FEC. However the government save the cost GBEC, a substantially greater saving for the benefit lost.

The drawbacks of the co-payment system are obvious. here are just two:

1. The system is regressive. As the lowest paid will pay the same as the best paid the $6 represents a higher percentage of their income. This affects the goal of equality.

2. As health care is an imperfect information good patients are not well placed to decide if going to the doctor is a sensible thing. Some will keep the $6 and miss the chance of the early diagnosis and treatment of a serious illness.