The 'tax incentive' allows people who buy property as an investment to earn higher profits from that investment in the long term. It is widely criticized as causing a less equal distribution of income as the benefits go to those who can afford to own more than one property. There are a substantial number of investors who own multiple rental properties.

Those who defend the use of negative gearing claim that it helps lowers rents for those who cannot afford to buy their own home. This is because it allows landlords to rent at a loss.

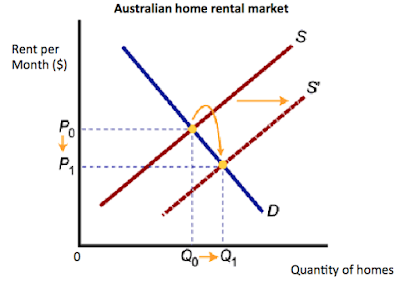

The economics of this can be explained using demand and supply.

Figure 1

Figure 1 shows that as the cost of buying a rental property is now lower, the supply curve of rental homes shifts to the right (S to S1). The market equilibrium rental price falls from 0P0 to 0P1, while Q1 - Q0 more homes are rented out at the new market rent, P1. It seems that renters share in the good fortune of the tax break given to investors.

The problem is this isn't really all that happens. It is a complex situation and we will focus just on the housing market. The fact that landlords can now recoup part of their loss on an investment means they can afford to pay more for any given property. This raises the demand for housing and, given that the stock of homes is very limited (inelastic supply), we can expect this to drive up the price of homes. Figure 2 shows how the effective subsidy for landlords shifts the demand for homes from D1 to D2, that leads to a rise in the price of homes to 0P1 from 0P0. The inelastic nature of house supply means that the price rise might be quite significant compared to the demand shift.

Figure 2

The result of this rise in the price of buying a new home means that landlords costs are higher than they would otherwise be, wiping out at least part of the gains from Figure 1 (S1 does not shift as far to the right). Further the higher price of buying a home means more families have to rent as they cannot afford to buy. So the demand for rented accommodation in Figure 1 shifts to the right, resulting in higher rents.

It is therefore not at all clear that negative gearing helps renters. It certainly reduces the tax bill of landlords however and that makes it difficult for weak politicians to tackle the problem. There is no doubt in my mind that negative gearing represents an unjustified transfer from taxpayers generally to landlords and helps skew the distribution of income towards the higher income deciles of Australian society.

The ABC explain why the scrapping of negative gearing wont push rents up and some of the history of the tax concession in the article below.

This article is relevant to VCE students for Unit 4, budgetary policy and for the goal of equity of income distribution. It is relevant to VCE and IB students as an application of supply and demand analysis using elasticity and an example of government failure in their intervention in a market.

No comments:

Post a Comment